E-invoicing is developing slowly in Europe. The development work takes place in work groups giving recommendations that need not be adopted. The end result has been “bottom-up” development where development cycles are more than 5 years. Should Europeans learn from others?

In Latin America, the development is driven “top down” by the state. Relevant interest groups can influence the planned legislation, after which the legislation forces the adoption of e-invoicing. The development cycles have been less than 2 years! As a result, the share of e-invoices of all invoicing in Latin America is the highest in the world. The model seems to work better than the European.

As Billentis’ e-invoicing thought leader Bruno Koch puts it:

“With all due respect for the federal European approach: From the starting point to reach a significant digital market adoption rat, the LATAM model is 4-5 times faster than the European one. In addition it is based on standardised, structured and fully validated invoice data. In terms of quality and quantity it is superior.”

Many Latin American countries have adopted a so-called clearance model, where the supplier needs to first send the invoice to the tax authorities who approve it (”clearance”). Only after that are you allowed to send the invoice to the customer. All this takes place through e-invoicing. Bruno Koch predicts that the same model could be useful and possibly adopted in Southern European countries with a large shadow economy and public debt.

According to Bruno Koch, the trends affecting e-invoicing in Europe are:

- Zero growth: This causes cost pressure. E-invoicing with more efficient processes is a remedy. Zero growth also brings about tax evasion which could be tackled with e-invoicing.

- Zero interest rates: This induces a growing interest in supply chain financing and dynamic discounting. Banks and investors aim to enter this lucrative market where earnings exceed those in the finance market. Operators and companies providing software for invoice handling now offer financing services on the side.

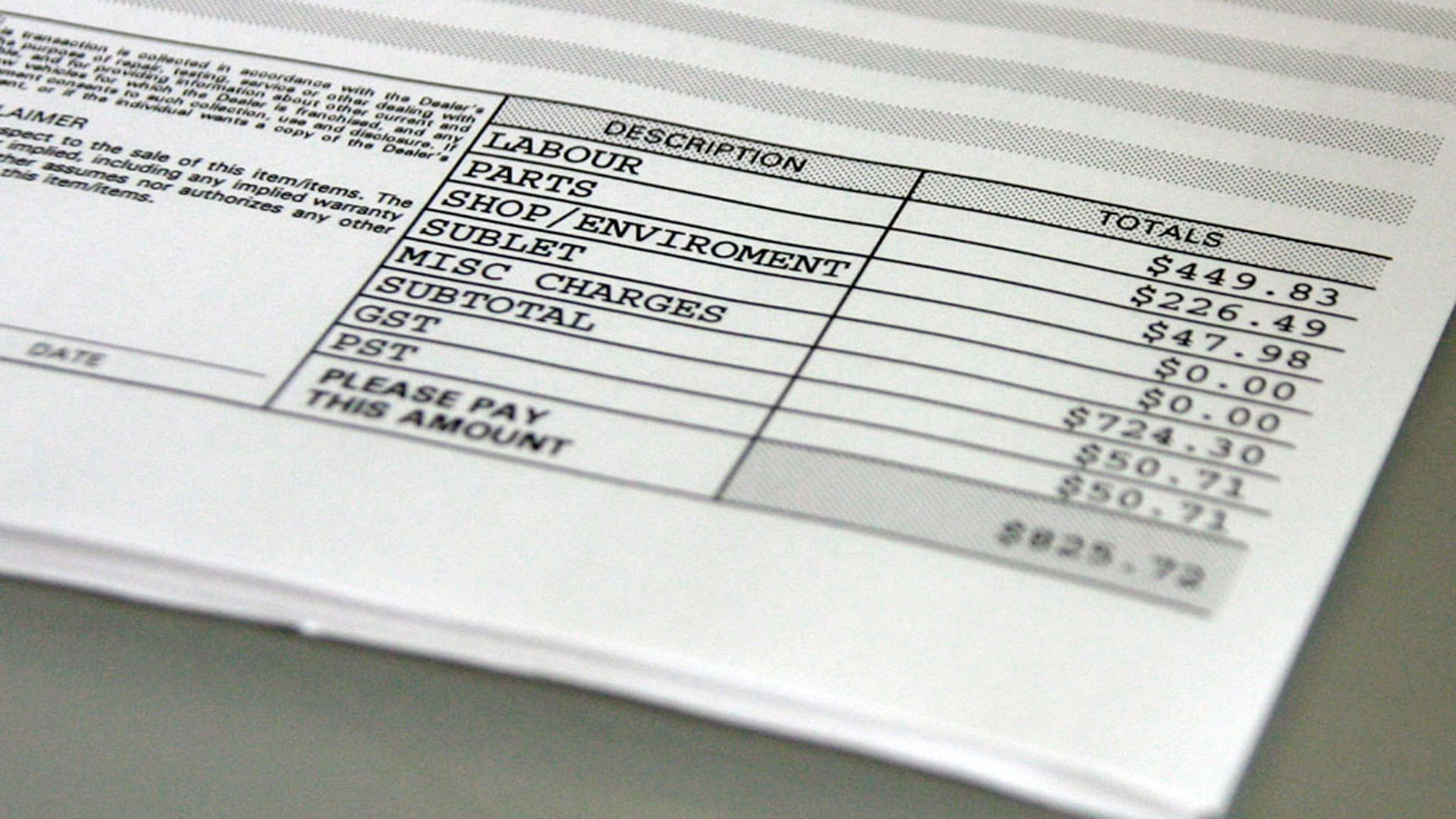

Requirements for invoice data accuracy slow e-invoicing adoption down in Europe. Many EU countries have compulsory requirements on data not required in the EU directive. Content requirements may be a condition for VAT deduction. There have been several law suits in Europe concerning losses of VAT deduction caused by minor mistakes on invoices. In a case example a company had moved some weeks earlier, and the invoice was addressed to the old address. As a result the VAT was not deductable. Different countries having different content requirements complicates international invoicing. The lawyer presenting the topic suggested unifying tax legislation within the EU.

In 2013, approximately 162 billion euros of VAT remained uncollected due to shadow economy and abuse. This is why the tax authorities in different coutries increase the bureaucracy in invoicing and reporting, increasing also the administrative burden on all companies, including those that take care of their taxes.

EU has studied reasons for late payments. The most important ones were:

- 15,1%: inaccurate invoice data

- 11,6%: invoice sent to the false recipient internally for review or approval.

The suggested remedies for these were national registries of recipients of e-invoices (from which ERP systems could validate e-invoicing addresses), electronic orders that can be translated into e-invoices, invoice data validation at the invoice sender and recipient and data synchronization between partners.

Several EU countries are forcing e-nvoicing to public organizations, or have already done so. For example Spain adopted this in the beginning of 2015. Exceptions are, e.g. the U.K. and Germany where this is not even being planned. On the other hand France is the only country planning to make e-invoicing compulsory on BtoB trade. The panelists were wondering why this is not forced everywhere, as it would bring only benefits to the economies.

E-invoicing operators still have very few interoperability contracts. EESPA is the European E-Invoicing Service Providers Association that aims at enabling networking between operators. Basware from Finland has grown to be one of the largest operators globally.

EU is drafting a consistent e-invoice format that would be used for invoices sent to public organizations. This would not necessarily affect invoices between companies.

Exchange Summit is an annual event bringing together people interested in e-invoicing and digitalization. The event took place in Barcelona October 4 to 6, 2015. Next year’s event will be on October 10 to 11.